Early Stage Startup Funding

This page shows the slides and additional links from my talk at the VentureFest South Conference 2024: Innovation Talks.

I spoke about: how to find early stage investors and funding for your startup, what investors want to see, and some tips for pitching to investors.

Funding Questions for Founders

Alignment

Do you need funding?

What will that funding help you achieve that you - couldn’t do otherwise?

What are you trying to achieve with your business?

Where do you want to get to and in what time frame - what’s your personal ‘end game’?

Why are you doing this? What’s the underlying difference your business will make in the world?

What do you believe about how you want to build your company? What are your non-negotiables?

What is important to you about your close personal and professional relationships? What type of people do you work best with? What do you need from a potential partner and what do you offer?

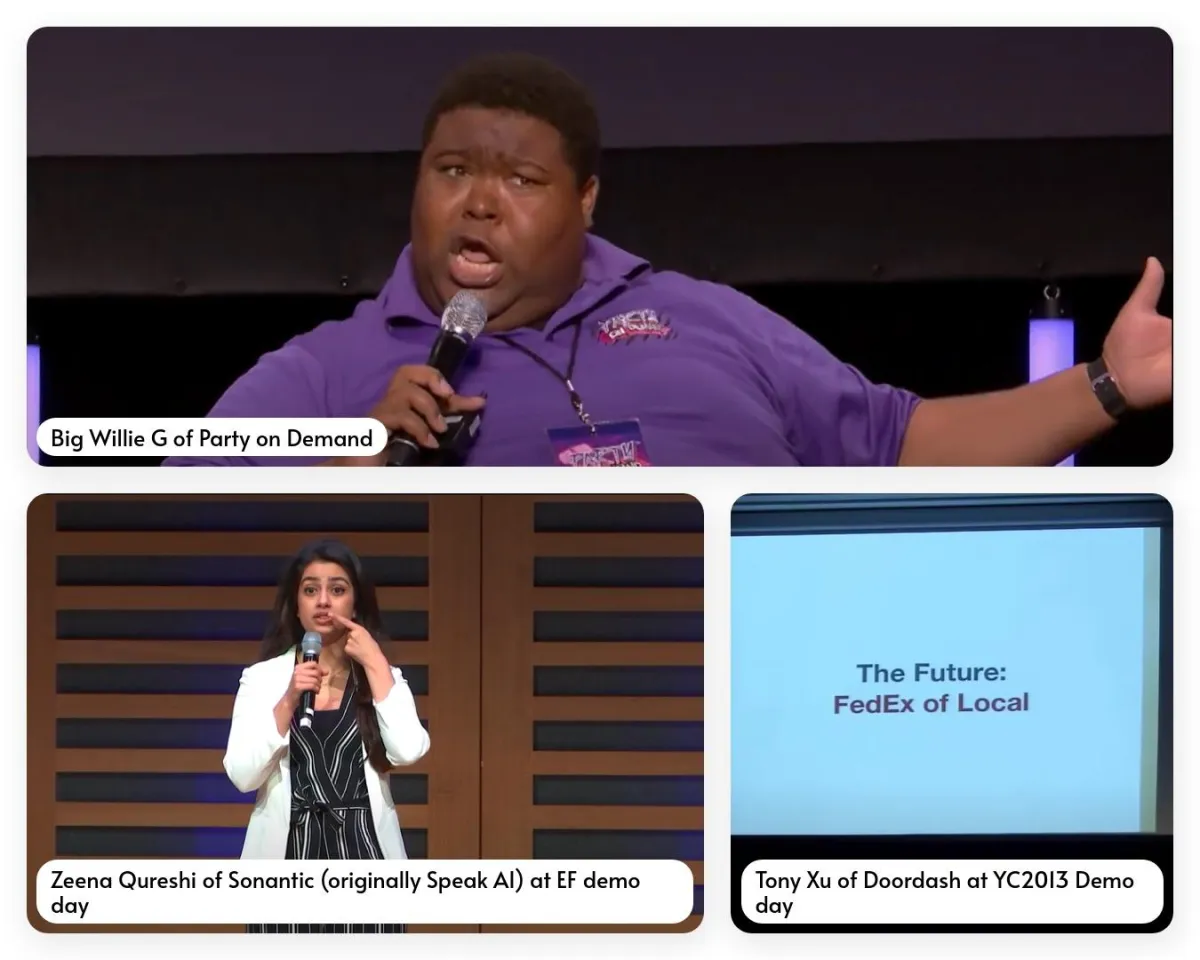

Prepare Your Pitch

Who is the audience (both at the time and who may watch later)?

What action do you want them to take?

What aspects of your company, product, personality, brand, story, are the strongest for the points you want to get across and the goals you’re trying to achieve?

What are your constraints (length of pitch, able to answer questions or not, must mention (or not mention XYZ, etc)?

Your Funding Prep List

Your ask <> their goals

How much you are looking to raise, how you will use those funds and the “runway” this will give your business. Does this match with what their business actually does? (checking for alignment)

Not having this > fastest way to a “no”.

Problem + solution

What problem are you solving and what is your solution (product) doing to solve it

Market Opportunity

Ideal (“target”) customers, how you intend to reach them and sell, size of your market, including how much of the market you are trying to capture, i.e. the Total Addressable Market (TAM)

Value Proposition

What you offer your customers, how this is different from your competition and how you monetise your business model (ie how you sell and price your products and services)

Traction

Your chance to showcase the progress made and to highlight the key milestones achieved to date

Team

Introduce the founder(s), key people in your senior team and any notable investors or advisors, and their skills.

Financials

A summary of revenue achieved to date and forecasted growth, current burn and cash efficiency and forecast

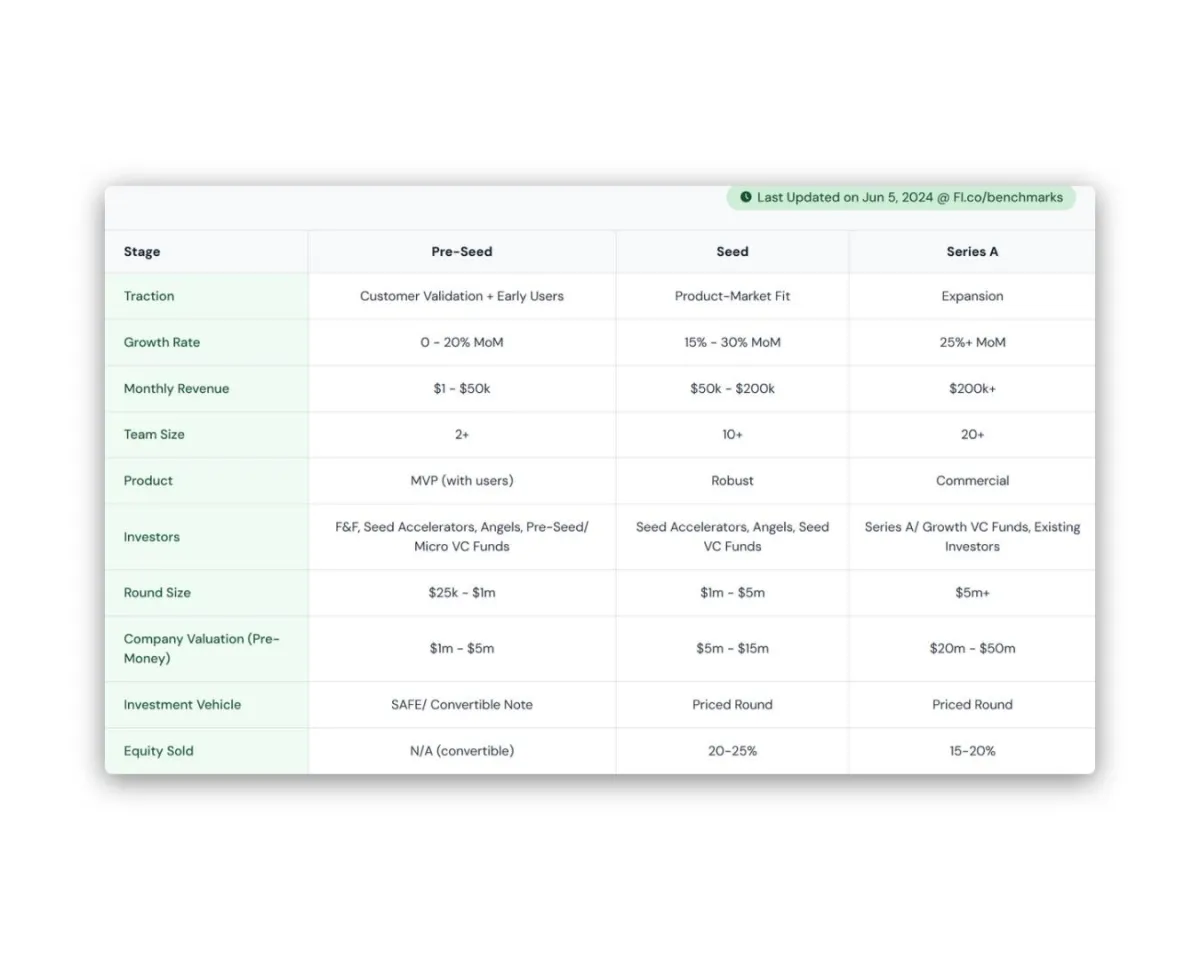

All investors will have their own processes and preferences for what they look at and how they would like to see it, which does make it harder for founders.

But most early stage (sometimes called ’pre-seed’ or ‘seed’) investors will be interested in all of these elements to some degree.

And in general if I had to pick two, it would be traction and team that always stand out as being the most important.

Although - your ask matching their goals is the first and most important, in the sense that if you don’t get past this it will automatically be a no. So DO NOT FORGET to think about alignment, and check in your research that you are a good fit as much as you can, before you even start pitching and speaking to them.